How a Man’s Earning Power Relates to Having Children — And How Islamic Finance Helps Families Thrive

“How a Man’s Earning Power Relates to Having Children — And How Islamic Finance Helps Families Thrive" by Mogamat Ali Salie

Becoming a father reshapes a man’s world; it changes his ambitions, his work, and the financial pressures he carries. In South Africa, fatherhood often coincides with shifts in income, living costs and long-term financial responsibilities. For many men, as business grows, productivity improves, and wages increase over time. Yet, parallel to this, the cost of raising a child keeps rising and often outpaces wage growth.

To understand this dynamic, it is helpful to look at three sets of data: how fertility trends are shifting; how fatherhood affects earnings; and what it actually costs to raise a child in South Africa. Once we see that picture clearly, the value of Islamic finance becomes unmistakable; it gives families the structure, risk protection and discipline needed to navigate one of life’s most meaningful transitions.

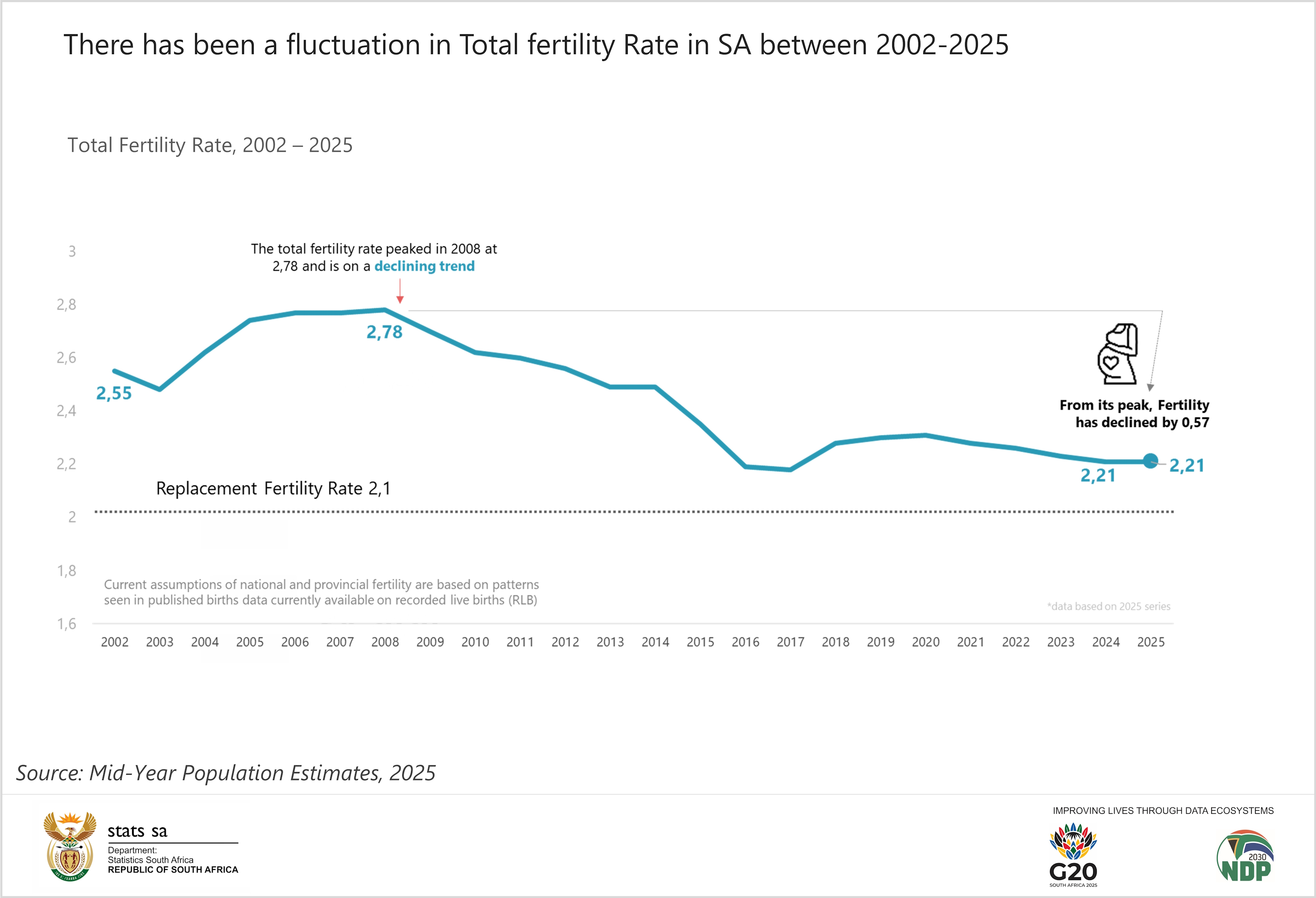

1. South Africa’s Fertility Trend — Fewer Children, Higher Stakes

South Africa’s total fertility rate has gradually declined over the past 15 years. In 2008, the rate stood close to 2.78. By 2025, it sits near 2.21 — still around replacement level but noticeably lower. Fewer children per household means each child becomes a larger financial and emotional investment.

Visuals:

South Africa Fertility Rate (Sparse Points 2008–2025)

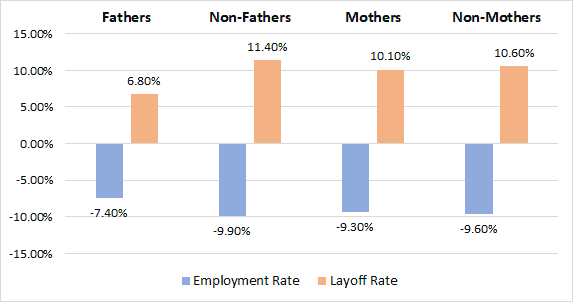

2. Fatherhood & Earnings — Understanding the “Fatherhood Premium”

Many international studies find that men who become residential fathers experience a small but steady increase in earnings — sometimes called the fatherhood wage premium. One recent study reports an average 1.2% wage gain per year for residential fathers. This does not mean every father earns more. Rather, the combination of career stability, increased motivation and employer perceptions creates a measurable effect.

When compounded over time, that small percentage becomes significant.

Visuals:

Illustrative Cumulative Fatherhood Wage Gain (1.2% Annual Effect)

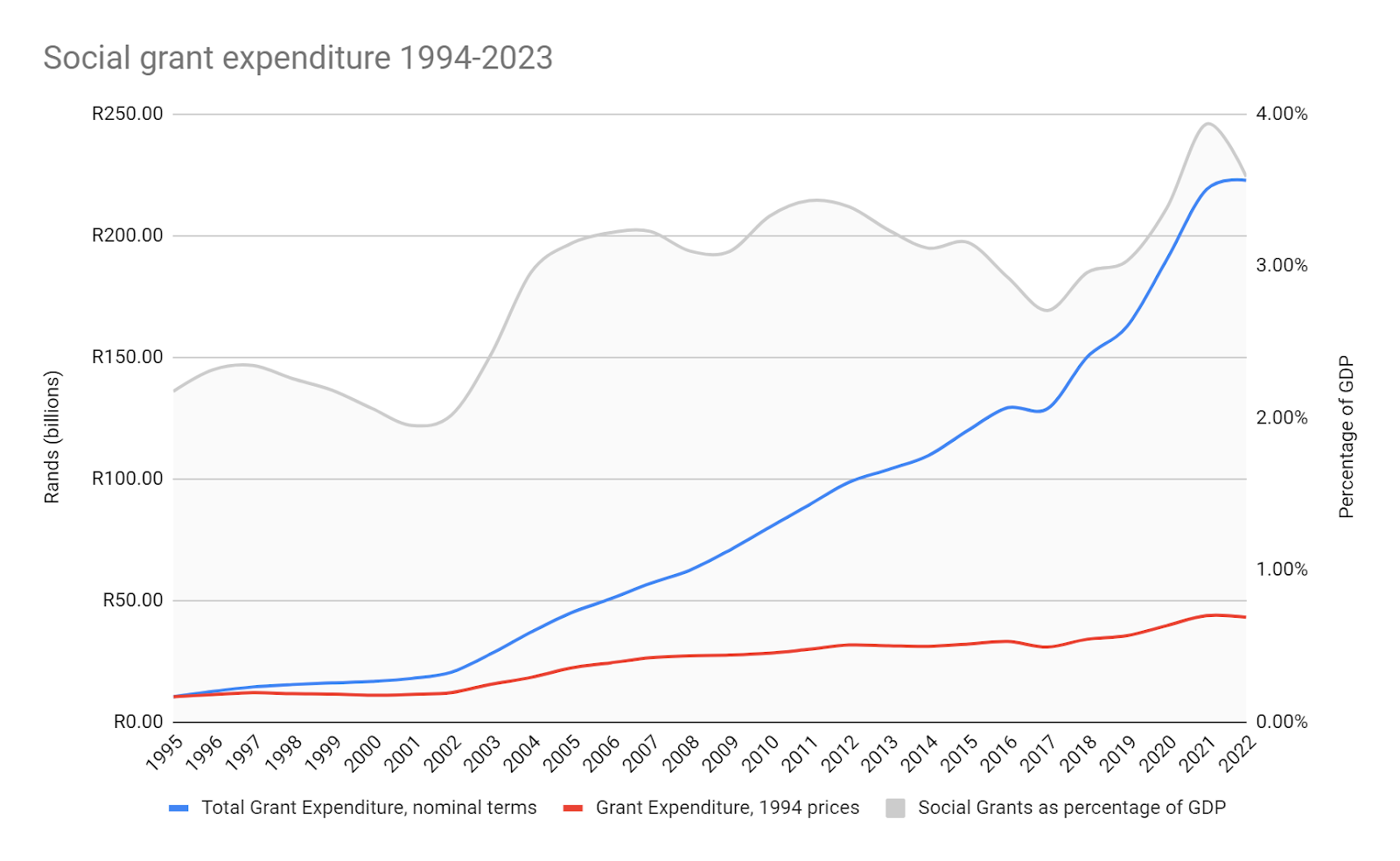

3. The Real Cost of Raising a Child — South Africa’s Numbers

While income may rise steadily, the cost of raising a child often rises faster. Recent South African estimates show:

Discovery: ± R1.68 million from birth to age 18 for middle-income families.

Momentum (public summary): ± R3 million for full education and living costs.

The gap between income growth and expense growth is where most families feel the pressure.

Visuals:

Comparison: Lifetime Cost of Raising One Child (South Africa)

How Islamic Finance Helps Families Close This Gap

Islamic finance offers practical tools that help parents align financial choices with faith values while managing risk, protecting income and preparing for rising costs.

1. Takaful — Income Protection Without Interest

Takaful provides Shariah-compliant protection against:

Income loss

Disability

Death

Critical illness

For fathers, it functions as the cornerstone of household stability. Should income stop unexpectedly, the family receives structured support without exposure to riba.

2. Murabaha — Predictable Financing for Major Child-Related Costs

Murabaha (cost-plus financing) helps families fund:

School fees

Technology for children (laptops, devices)

Home renovations for more space

The fixed markup removes uncertainty, allowing families to plan accurately.

3. Islamic Savings & Sukuk-Based Plans — Building Education Wealth

Rather than relying on interest-bearing accounts, families can use:

Profit-sharing investment accounts

Sukuk-linked savings

Structured Islamic education plans

This creates long-term education capital, free of riba and aligned with responsible stewardship.

4. Waqf Structures — Generational Education Funds

A family Waqf can secure:

Tertiary education for future grandchildren

Medical support

Permanent funding for family needs

It keeps capital intact while distributing benefits across generations — a powerful intergenerational tool.

5. Zakat & Sadaqah Systems — Community Support for Vulnerable Families

For lower-income households, these social-finance instruments provide safety nets:

School uniforms

Transport costs

Emergency food and healthcare

Early childhood interventions

Islamic finance does not separate economic planning from social justice; both rise together.

Closing Reflection

Fatherhood reshapes a man’s financial world; it sharpens his drive, expands his responsibilities and exposes him to new risks. The data shows that while income may grow steadily, expenses grow faster. This is where structure matters.

At MuslimFin Family Office, we help fathers and families build resilient, Shariah-aligned financial plans that protect income, soften the cost curve and secure the next generation.

References

Statistics South Africa. Mid-Year Population Estimates (2025).

Statistics South Africa. Demographic and Health Survey Reports (Various Years).

Gowen, A. (2023). An Examination of the Cumulative Wage Premium for U.S. Residential Fathers.

Mari, G. (2019). Is There a Fatherhood Wage Premium? A Reassessment in Light of Selection and Different Outcomes for Men and Women. Journal of Marriage and Family.

Kunze, A. (2020). The Effect of Children on Male Earnings and Inequality.

Miller, A. R. (2011). The Effects of Motherhood Timing on Career Path. (Referenced for comparative parental analysis context).

Discovery Health. Budgeting for Baby Report (2024).

Momentum/Metropolitan Group. Cost of Raising a Child in South Africa (Media Summary, 2023).

IFSB (Islamic Financial Services Board). Guiding Principles on Takaful Operations.

AAOIFI. Shariah Standards for Murabaha, Sukuk and Waqf.

United Nations Development Programme (UNDP). Islamic Finance for Development and Social Welfare.

Kammer, A., et al. (IMF). Islamic Finance: Opportunities, Challenges and Policy Options.